“Mailbag” offers some insight into comments I get from readers — good, bad or in-between — and my thoughts about their feedback. It’s uncomfortable to talk about the nation’s ugly housing past and even more unnerving to think that many of the inequities still exist in the homebuying system today.

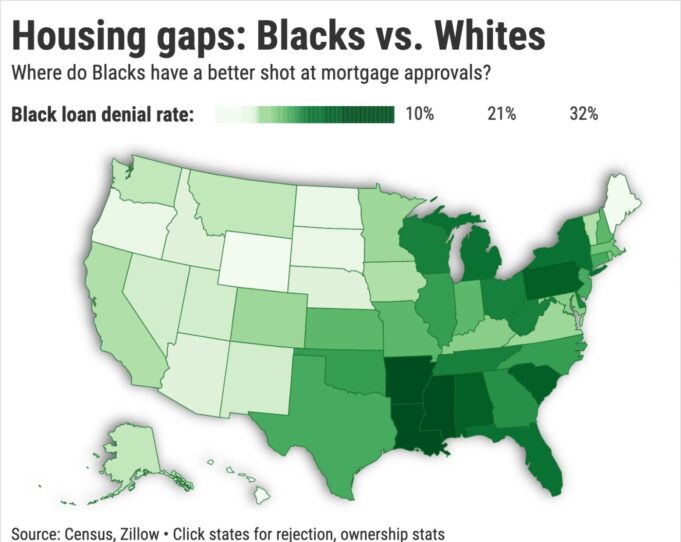

Despite modest improvements, the housing market is not totally fair, preventing families of color to take advantage of a wealth-building system that has been passing money to White families for generations. All that said, I was not surprised to see heated critiques in my inbox after I wrote about a Zillow report that showed getting a mortgage approved was tougher for Black applicants vs. Whites. Census stats also told us that Blacks have far lower homeownership rates. In California, Black residents were 43% less likely than Whites to live in a home they own and were rejected for a mortgage at a 48% faster rate.

Here’s what readers had to think about my column and the reports …

Reader: “Ownership has nothing to do with race. It has everything to do with choices that people make in their lives. Are they taking advantage of America’s vast opportunities, getting an education, and working hard? Or are they making poor life choices in terms of investing and saving?”

Me: The National Association of Home Builders wrote in 2021: “The path to homeownership has not been equal to all. Housing segregation and racial structural inequity in housing is a fact, perpetuated by both public and private actors. There is overwhelming evidence that much of the housing equity divide was effectuated through various federal, state and local government policies. Although important civil rights laws, such as the Fair Housing Act, have certainly helped to combat historical and ongoing discrimination, local exclusionary land use regulations in particular continue to create inequity in housing.” Reader: “No agent, loan processor, loan committee — which are virtually computer driven — could care less what the color of the buyer is.”

Me: An investigation by The Markup of 2019 loan data found “Holding 17 different factors steady in a complex statistical analysis of more than 2 million conventional mortgage applications for home purchases, we found that lenders were 40% more likely to turn down Latino applicants for loans, 50% more likely to deny Asian/Pacific Islander applicants, and 70% more likely to deny Native American applicants than similar white applicants. Lenders were 80% more likely to reject Black applicants than similar white applicants.”

Reader: “Perhaps your trusty spreadsheet should include average credit scores for blacks, average income for black families and stop with the inequity bull.”

Me: The Urban Institute wrote in 2021 : “Majority-Black communities and majority-Native American communities have the lowest median credit scores and the highest debt in collection rates, subprime credit score rates, and use of high-cost payday and other alternative financial services loans. These racial disparities reflect historical inequities that reduced wealth and limited economic choices for communities of color.”

Reader: “Does anyone realize the harm that’s done making everything about inequality between just Whites and Blacks?”

Me: Soon after Charlie Oppler was installed in 2019 as National Association of Realtors President he issued a formal apology for the group’s role in preventing equal ownership opportunities for Blacks, initially fighting the Fair Housing Act in 1968, and once letting membership be based on race or sex. “What Realtors did was an outrage to our morals and our ideals. It was a betrayal of our commitment to fairness and equality. We can’t go back to fix the mistakes of the past, but we can look at this problem squarely in the eye. And, on behalf of our industry, we can say that what Realtors® did was shameful, and we are sorry.”

Reader: “My parents former two-bedroom, 70-year-old home in west suburban Chicago (now Black owned) is worth $137,000. My 48-year-old home, three-bedroom home in South Orange County is worth $958,000. While my Black neighbor’s four-bedroom home is worth more likely $1.1 million.”

Me: The National Community Reinvestment Coalition wrote last year : “Redlining, the intentional decision not to provide mortgage loans in minority communities, specifically African American communities, led to the formation and enhancement of segregated neighborhoods. Many of the neighborhoods redlined back in the 1920s-1940s are still segregated today.”

Reader: “Forget about Critical Race Theory. How about teaching kids to balance a checkbook and budget? Boring. Better to convince kids they are either victims or oppressors.”

Me: Amen to more practical education. But we can teach both “home economics” and an accurate snapshot of our nation’s history, good and bad.

Written By Jonathan Lansner for The OC Register | Jonathan Lansner is business columnist for the Southern California News Group. He can be reached at jlansner@scng.com